About

Our Process

Our team understands the different milestones of life, and the challenges they bring. We work to ease the stress of each transition using our years of experience, research, and resources alongside your values and desires, to design a successful plan of action.

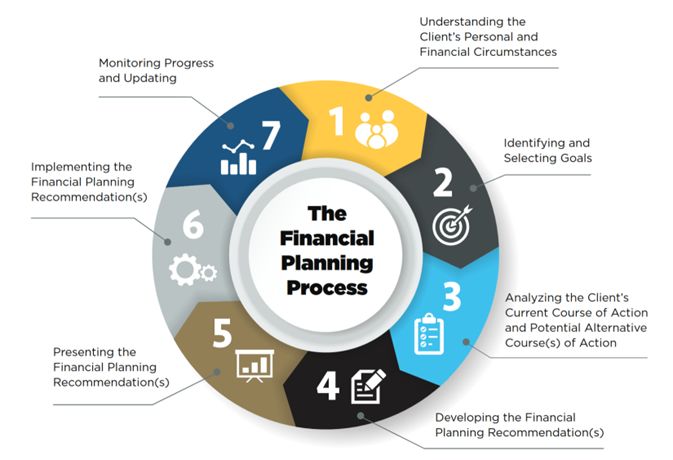

We follow the CFP Board's 7-Step Financial Planning Process

- 1. Establish and Define the Scope of Work

- 2. Gather Information, Identify Values, and Set Goals

- 3. Analyze and Evaluate the Current Status

- 4. Develop Recommendations and Create Plan

- 5. Review and Amend the Plan

- 6. Implement

- 7. Monitor and Review

-

1. Establish and Define the Scope of Work

This step is essentially the icebreaker between the client and the Certified Financial Planner™ (CFP®). The CFP® collects qualitative information such as client’s health status, life expectancy, and family circumstances to begin identifying and evaluating the client’s specific needs, wants, goals, and expectations. From this point, the CFP® and the client agree upon the scope of the plan. -

2. Gather Information, Identify Values, and Set Goals

The second step of the process entails digging deeper into the “nitty gritty,” if you will. The CFP® will collect quantitative information, including income and expenses so they can put a pen to paper and begin crunching numbers. This is when the CFP® and client will discuss the client’s values and attitudes towards planning to select and prioritize goals in accordance with current financial information. -

3. Analyze and Evaluate the Current Status

During this step, the CFP® will use the information collected during Step 2 to gauge where the client stands in terms of investments, insurance coverage, risk management, employee benefits, retirement planning, and estate planning. The significance of the aforementioned items will vary based upon the client’s personalized financial plan, but analyzing the status is important to determine whether the client is on track to meet his/her goals. If the client is not on track, then the CFP® may decide to brainstorm or implement alternative courses of action. -

4. Develop Recommendations and Create Plan

At this point, the CFP® will begin making recommendations and drafting up the client’s financial plan. The CFP® will forecast the plan, taking different lifestyle and economic scenarios into consideration. This plan is designed to maximize the client’s potential to meet his/her goals. -

5. Review and Amend the Plan

During this step, the CFP® will sit down with their client and discuss the proposed plan. The CFP® addresses observations and recommendations, then offers feedback to the client. From here, the CFP® and client discuss any changes to be made to the plan. -

6. Implement

The key component to implement a financial plan is communication. The CFP® and client must clearly define who is responsible for what and establish a clear timeline delineating deadline for each party. -

7. Monitor and Review

The final phase may last years or even decades. This is when the CFP® is responsible for monitoring the client’s plan at regular intervals to watch for success and make any necessary changes. If the CFP® is a fiduciary, they must always have the client’s best interest in mind. For the duration of the engagement, they will continually account for the significance of any new information or life changes.

Financial Advice

Financial advice is not merely about numbers; it's about empowering individuals to make choices that shape their futures with confidence and clarity

Start a Conversation

Schedule a complimentary introductory consultation to discover how our services can support your financial aspirations.